Investment funds (IFs) are commonly organised as limited partnerships (as opposed to corporate entities) to ensure tax neutrality for their investors. This puts investors in the fund in a similar tax position as if they had invested directly in the underlying assets of the fund. Investment funds that are structured as partnerships, unit trusts and other unincorporated vehicles would generally be treated as fiscally transparent “Unincorporated Partnerships” for the purposes of UAE Corporate Tax.

Therefore, generally an Investment Fund is tax exempt. The law has outlined few conditions for exemption of IFs:

The IF or the IF’s manager is subject to the regulatory oversight of a competent authority in the UAE, or a foreign jurisdiction; Interests in the IF are traded on a recognized stock exchange, or are marketed and made available sufficiently widely to investors; The main purpose of the IF is not to avoid corporate tax.

Additional conditions for IFs except Real Estate Investment Trusts (REITs):

The fund should primarily be engaged in investment business with ancillary or incidental activities not exceeding 5% of its total revenue; the share of ownership interests in the IF held by a single investor and its related parties do not exceed 30% (when the IF has less than 10 investors) or 50% (when the IF has 10 or more investors). Further, this condition will be deemed to be satisfied for the first two financial years and will be non-binding following the first two financial years, provided that the same may be substantiated; the fund is overseen by an investment manager employing a minimum of 3 investment professionals; The day-to-day management of the fund is not being controlled by investors.

Additional Conditions for REITs:

Real estate assets, excluding land held by the REIT, exceeds Dh100 million in value; A minimum of 20% of its share capital is publicly listed or wholly owned by two or more institutional investors, such as the federal or local government, government entity or government-controlled entity, foreign government, bank, insurance provider, pension or social security funds, etc; An average real estate asset percentage of at least 70% is maintained annually.

It is important to note that for UAE based investors currently there is no income tax so any income earned from these investments will not be taxable ie Capital Gains, Dividends, Interests, etc. However, investments made in foreign funds may attract withholding rate of those foreign jurisdictions.

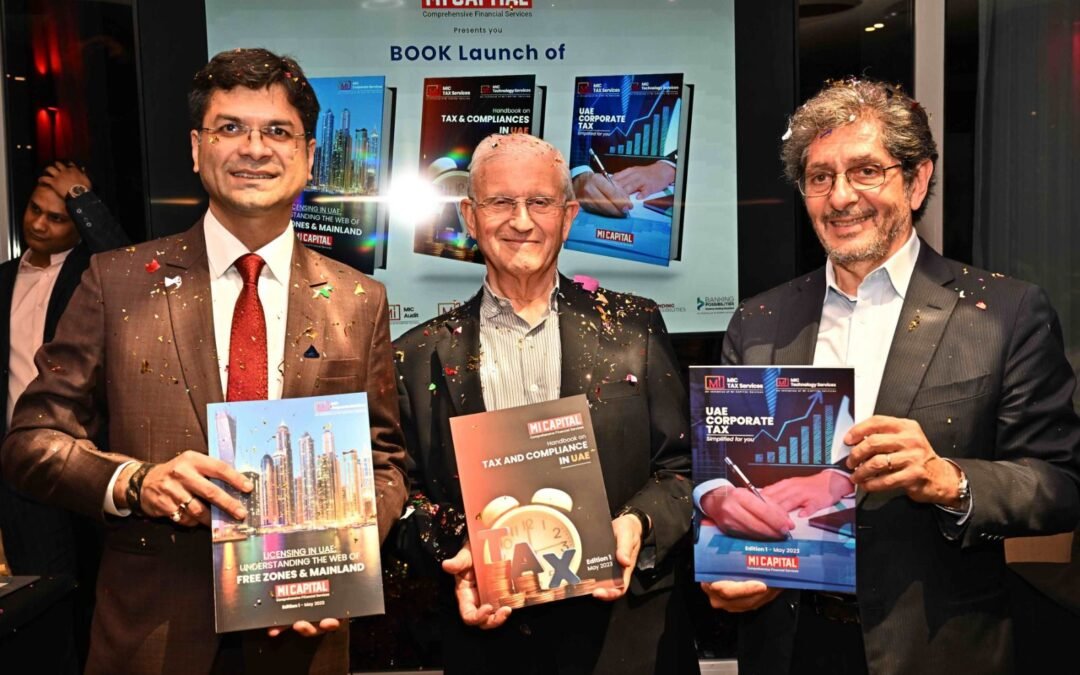

The writer is Partner – MI Capital Services.